Article written by Elisa - Travel Writer & Local in France

This article may contain compensated links. Please read disclaimer for more info.

All that you need to know about travel insurance for France and some of the best options available in the market — including those that you can book when you’ve already started your trip.

It’s important not to skimp on Travel Insurance when you plan a trip to France. Unfortunately, bad things happen when you least expect it, so the best thing you can do for yourself is to be insured.

SafetyWing is our preferred choice, starting from a minimum of 5 days – but of course, there are other options.

What Could Go Wrong in a Wonderful Country Like France?

Whether you plan a weekend getaway to Paris or a road trip to French Riviera, unfortunately, anything can happen, so it is better to play it safe. Apart from the travel-related risks (think lost luggage, delayed or canceled flights), getting sick abroad is, unfortunately, a possibility.

Sometimes trips don’t go as planned – that’s what insurance is for.

While a basic consultation in France is affordable (around 25€), hospitalizations or emergency evacuations can easily run into hundreds or thousands of US dollars, which you’ll be expected to pay before you leave. Having a travel insurance policy can give you peace of mind and is something most travel experts recommend.

How willing are you to take risks?

COVID-19 UPDATE: Some travel insurance providers may cover COVID-19 — as long as it was not contracted before the policy start date. Travel medical insurance provider SafetyWing covers COVID-19 and unexpected stays in quarantine for new policies.

France Travel Insurance Options for Different Travelers

Disclaimer: Always read the policy wording for any insurance very carefully before signing up. Terms and conditions can change over time and differ depending on factors like your age, country of residence, or how high you want your cover.

1.European Health Insurance Card (EHIC Card) + Complements

If you are traveling to France from other countries in Europe (actually from all EEA Countries + Switzerland), you may be ok with the European Health Insurance (EHIC) card. This healthcare card is free, you can order it online, and it will basically give you the same rights as in your own country’s healthcare system.

However, this is a healthcare card – not a travel insurance policy –, so you will be covered only for the medical part of your trip. Also, it is important to understand how much (%) of the medical expenses your healthcare system covers if you have an accident abroad.

2.Credit Card Travel Insurance

This is good-to-go insurance for us when we do weekend getaways in Europe because we have the European Health Card (we are in the French Social Security System).

However, it is important to check the terms of use of your credit card insurance to understand in which cases you can use it, what it covers, and for how long.

Read the medical expenses coverage part carefully. Many credit card travel insurance plans have very limited coverage for medical emergencies and medical care. This means that travelers are forced to pay out of pocket if they are injured during the trip.

3.Traditional Travel Insurance

Traditional travel insurance protects your trip essentials – including lost luggage, trip cancellation, and interruption – plus medical expenses, and evacuation.

What type of travel insurance you buy and with which company depends on where you’re from, where you’re traveling to, for how long, what you want to be covered for, and if you have any pre-existing medical conditions.

SCHENGEN TRAVEL INSURANCE: for those who require a visa to enter France or any other Schengen country, it is compulsory to have travel insurance covering repatriation and medical expenses. The necessary visa to enter Europe will not be issued unless you provide proof of suitable coverage.

Our Favorite Short and Long Term Travel Insurance

After a huge amount of research for our own trips, we use SafetyWing and find it to be an excellent travel insurance policy for long and short travels.

SafetyWing offers a combination of travel and medical coverage, covering you in case of an accident or sickness while you are outside your home country as well as coverage for travel delay, lost checked luggage, emergency response, natural disasters, and personal liability.

Founded in 2017, SafetyWing is a fairly new kid on the insurance block, but it is underwritten by Tokio Marine, Tokio Marine which is one of the largest insurance companies in the world.

If you are looking for good traveling insurance for France, SafetyWing is a good option. SafetyWing insures trips from 5 days to several years. For long trips, it’s set up with recurring monthly payments, like a subscription, and you can cancel at any time without penalty.

With SafetyWing, one young child per adult, up to 2 per family, age between 14 days and 10 years old, can be included on your insurance without added cost.

A bonus is that you can kick off your travel insurance plan any time, even when already on the road.

GOOD TO KNOW: Since August 2020, SafetyWing has also covered COVID-19 for new policies purchased, and since April 2021, unplanned quarantine is covered, too.

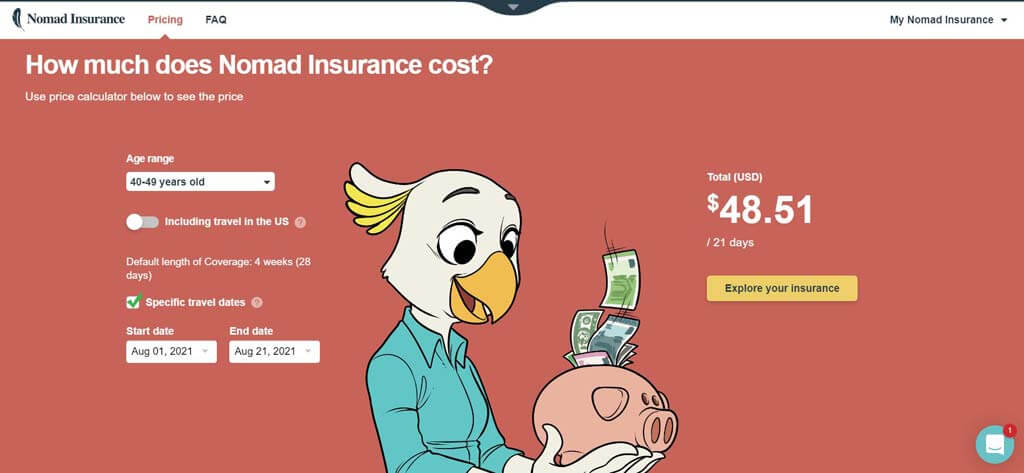

Pricing Example:

France travel insurance, two-week trip: for one adult (40-49 years old) from the United States, it costs $32.34 in total.

France travel insurance, three-week trip: for one adult (40-49 years old) from the United States, it costs $49.51 in total.

Seriously…don’t ever travel without travel insurance for France – you just never know what might happen and when you’ll need it.